Are you curious about your HRA benefit and how to use it? Click here to learn more.

Explore Your Benefits

Retirement

Retirement is not the end of the road; It's the beginning of a new journey.

The Blueprint - Winter 2026

For helpful resources and updates on your benefits, check out the new quarterly benefits newsletter from the Administrative Office.

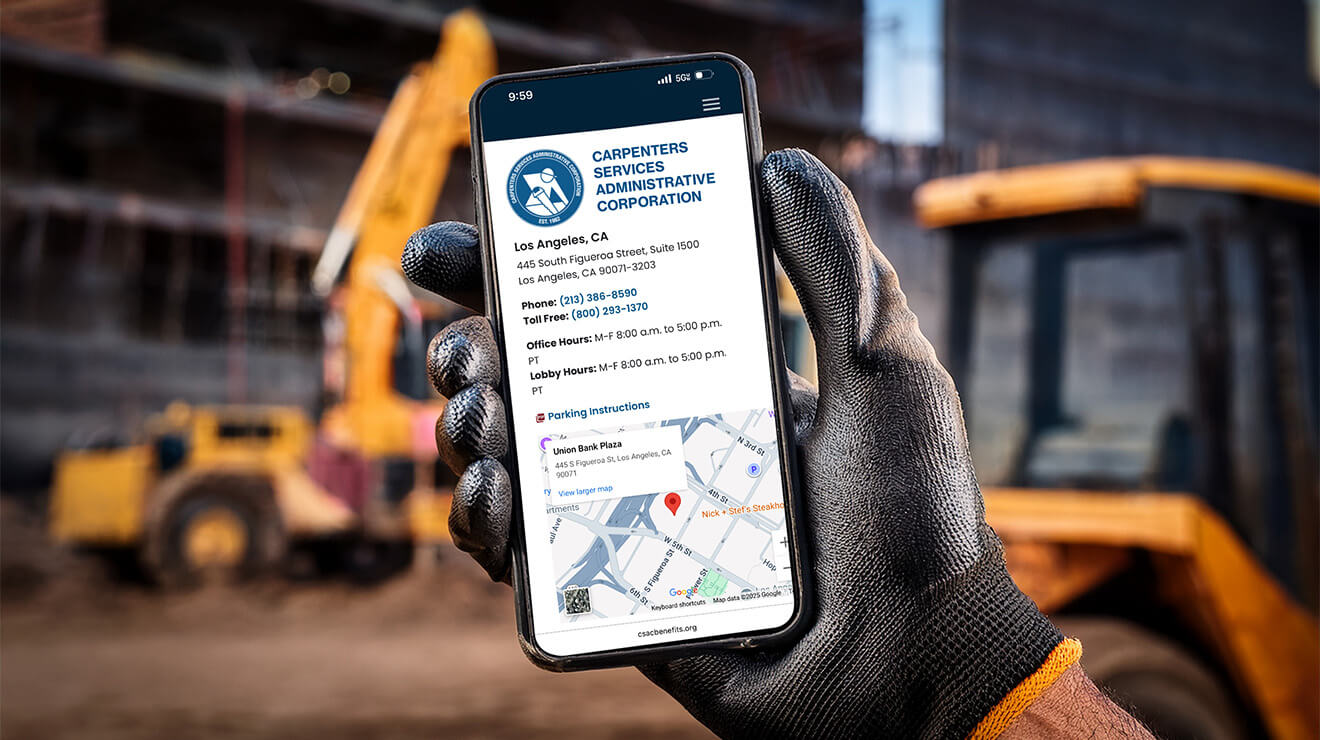

Get MemberXG: Your Benefits anytime, anywhere

Anytime access to eligibility and family information, vacation payouts, pension credits and more

Access for participants and their dependents

Optimized for viewing on the go with mobile devices

Sign up takes only a few minutes

I Want To...

- locate HIPAA Privacy Notice

- know about Surprise Billing Protections

- download the Participant Information Form

- know how COBRA works

- retire. What do I need to do?

- know how to add and/or drop a dependent.

- learn about new insurance cards from Independence

- access the Southwest Carpenters Reciprocity Form